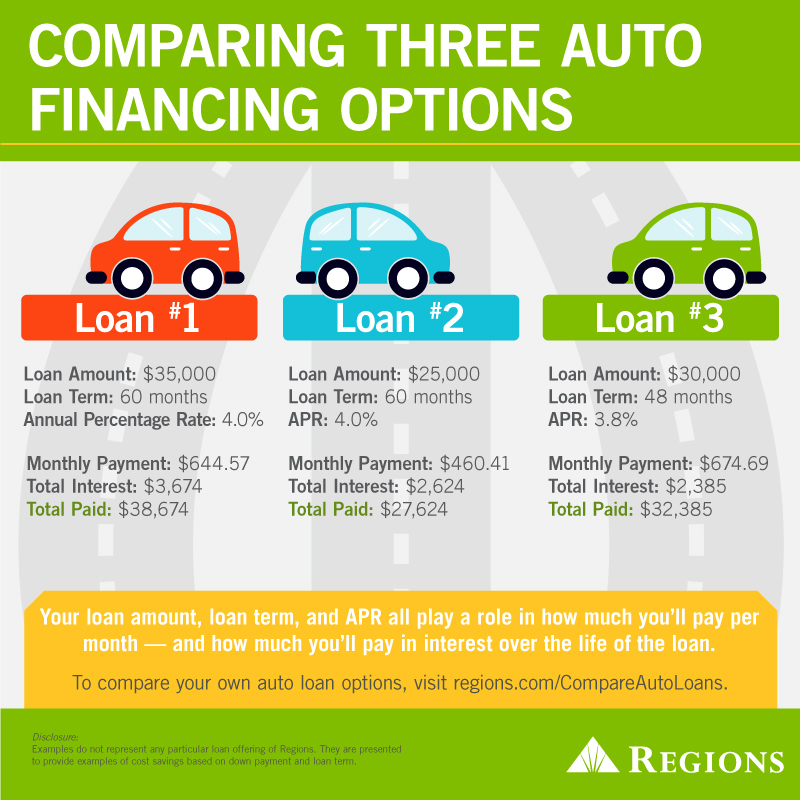

Auto Loan Trends 2025 - What You Need To Know About Auto Loan Delinquency Statistics, Subprime borrowers held an average rate of 11.72 percent for new cars and almost 19 percent for used, according to experian second quarter data. The average auto loan interest rates across all credit profiles range from 5.64% to 14.78% for new cars and 7.66% to 21.55% for used cars. How to Get Auto Financing When Buying Your First Car Regions Bank, Auto loan rate forecast for 2025; While it’s challenging to predict exactly what will happen with auto loan rates in 2025, several experts project that rates will likely remain the same or continue to rise.

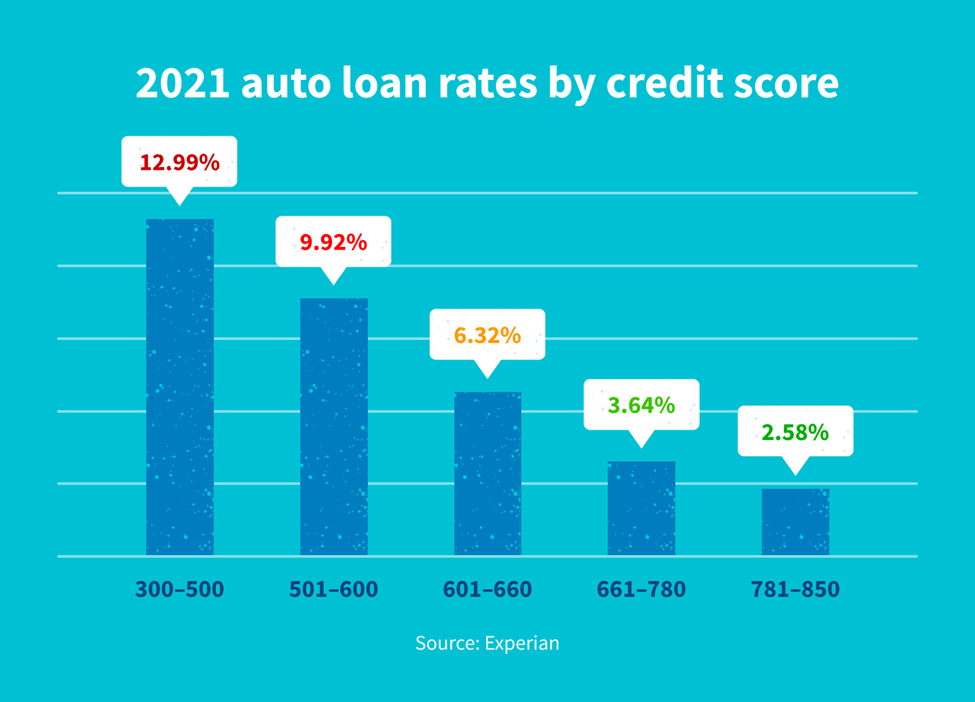

What You Need To Know About Auto Loan Delinquency Statistics, Subprime borrowers held an average rate of 11.72 percent for new cars and almost 19 percent for used, according to experian second quarter data. The average auto loan interest rates across all credit profiles range from 5.64% to 14.78% for new cars and 7.66% to 21.55% for used cars.

56 U.S. Auto Loan Statistics to Know in 2025, Subprime borrowers held an average rate of 11.72 percent for new cars and almost 19 percent for used, according to experian second quarter data. Here's what to expect in the auto industry this year.

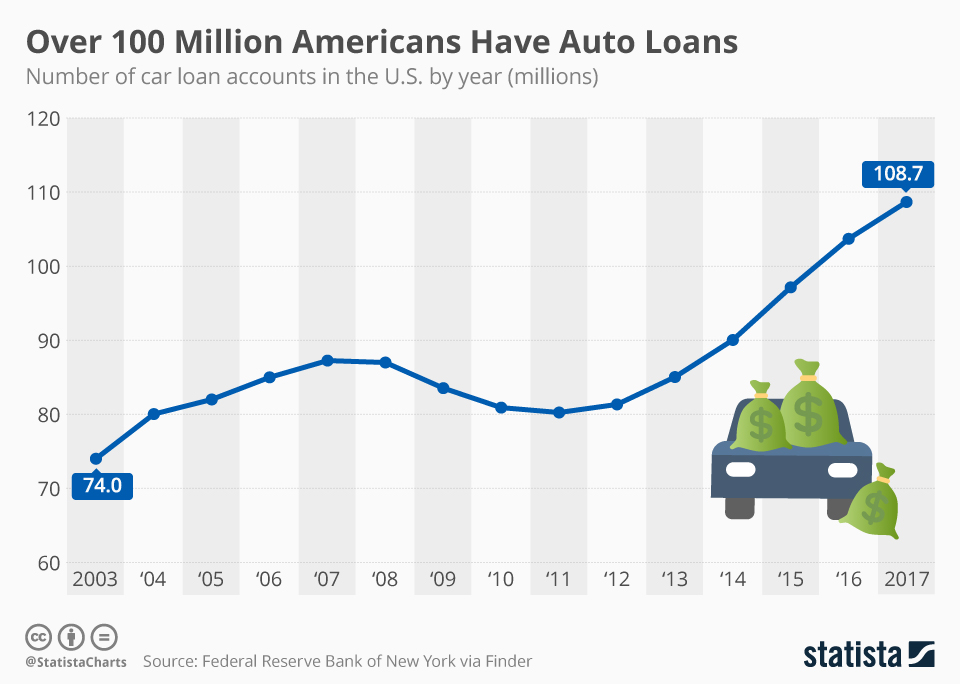

Chart Over 100 Million Americans Have Auto Loans Statista, Best from a big bank: Subprime borrowers held an average rate of 11.72 percent for new cars and almost 19 percent for used, according to experian second quarter data.

Best Business Car Loans 2025 Merchant Maverick, Prime recoveries increased month over month to 49.57% in. Credit card balances increased by $50 billion to $1.13 trillion.

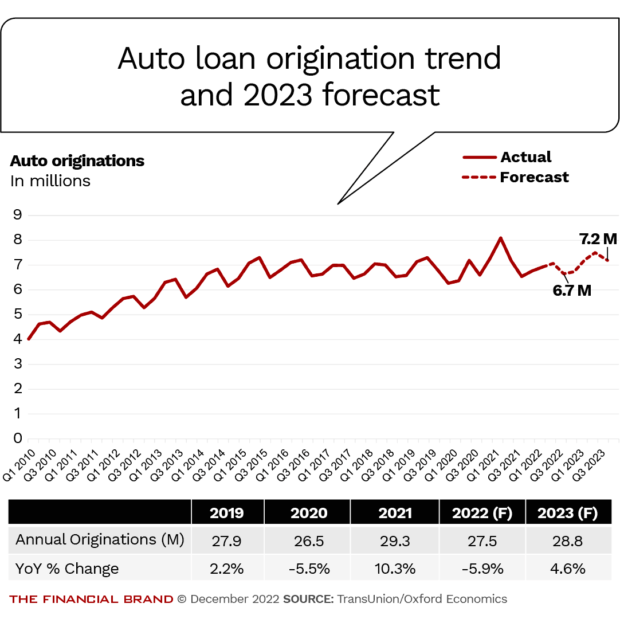

2023 Forecast Auto Lending Will Rev Up — But at a Price, Credit card balances increased by $50 billion to $1.13 trillion. Average car payments to financing by credit score average car payments for new, leased and used vehicles in the u.s.

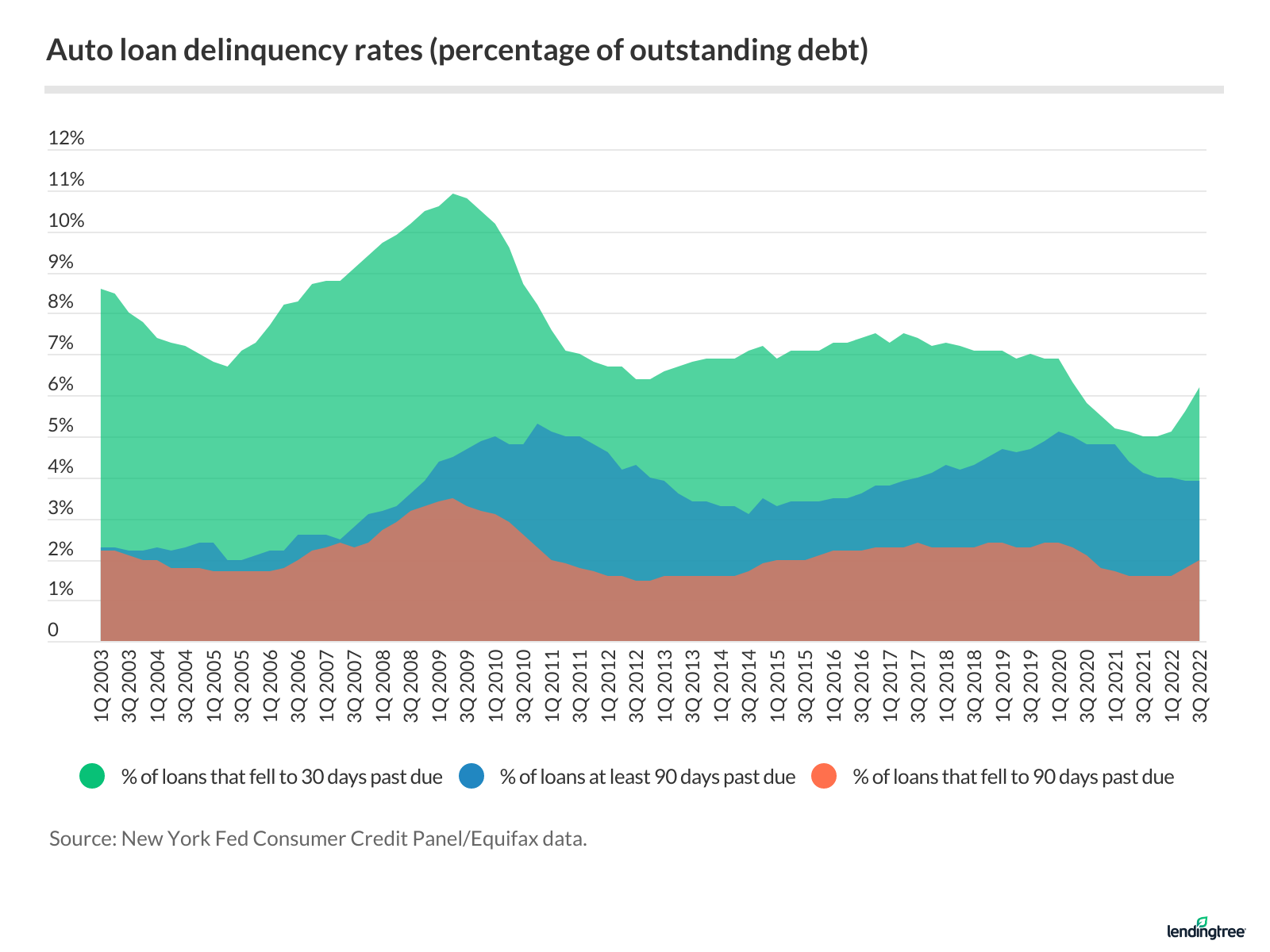

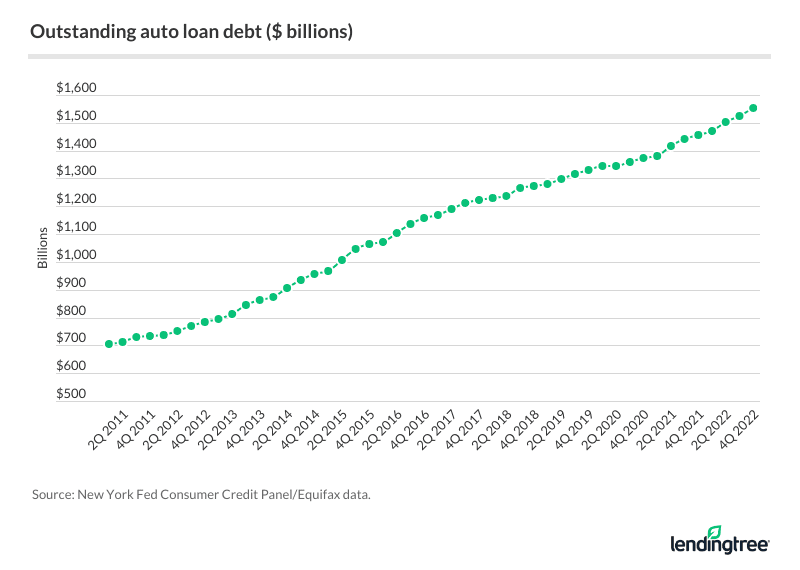

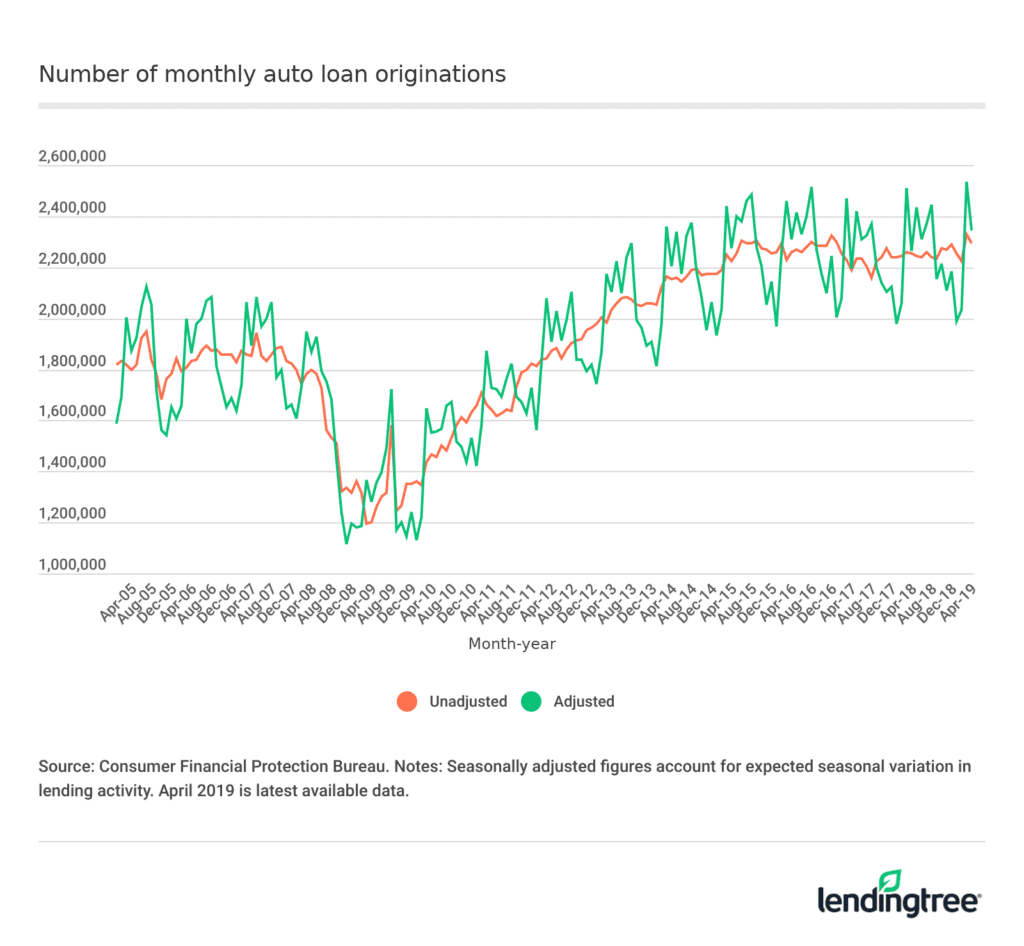

Average Car Payment and Auto Loan Statistics 2023 LendingTree, New york fed consumer credit panel / equifax, using philadelphia fed auto loan tradeline data. Updated on jan 4, 2025.

Average Car Payment and Auto Loan Statistics 2023 LendingTree, As of october 2023, the average new car loan apr is north of 9%. Mortgage originations continued at a similar pace as seen in the.

Average Car Payment and Auto Loan Statistics 2023 LendingTree, While market predictions are bullish on the funds rate — and by extension, auto loan rates — finally coming back down in 2025, it’s still not a guarantee. We've rounded up average auto loan rates for this month, and we'll help you learn why a lower rate is better.

Auto Loan Trends 2025. Borrowers falling under the deep subprime category, between 300 and 500, can expect rates over 14 percent for new and over 21 percent for used, according to. Cash will remain king in 2025.

Here's what to expect in the auto industry this year.

Auto Loan Trends Car Loan Statistics 2025 United Settlement, New york fed consumer credit panel / equifax, using philadelphia fed auto loan tradeline data. Subprime borrowers held an average rate of 11.72 percent for new cars and almost 19 percent for used, according to experian second quarter data.

Average car payments to financing by credit score average car payments for new, leased and used vehicles in the u.s.